US PPI has jumped to a 10 year high with expectation that higher costs will be passed on to consumers. This should add the upside CPI risk in the coming months. The question however, is will this lead to earlier fed policy.

As the PPI numbers exceeded expectations there is evidence of broadening price pressures. Core CPI rose 0.7% MoM versus 0.2% consensus forecast. Customer inventories are low while order books full effectively giving manufacturers pricing power we haven’t seen in years.

Upside risk for CPI and Fed rate hikes

Next week’s CPI is going to rise sharply. We expect it to jump from 1.7% to 2.4% year-on-year, but it is likely to get close to 4% over the summer as prices in a vibrant, re-opened, stimulus fuelled economy contrast starkly with those of twelve months before when the economy was largely in lockdown.

The Fed believe that inflation will then moderate, but we think that pandemic-related scarring and supply constraints will keep inflation elevated for longer than they do – as underlined by today’s PPI figure. We also think that the housing components will be an increasingly important story over the next twelve months.

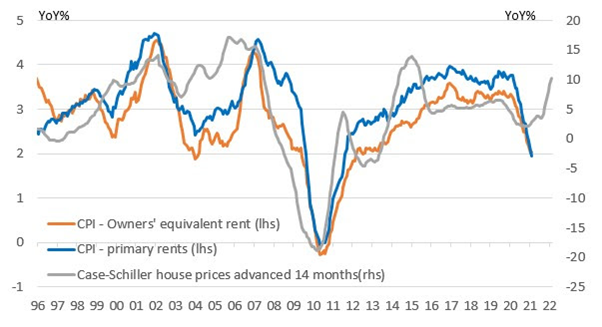

Primary rents and owners’ equivalent rent account for a third of the CPI basket of goods and services. Movements in these components tend to lag 12-18 months below house price developments, as the chart below shows, which means that the housing components may well be the story to watch through the second half of this year.

If these components do swing higher, as we suspect, this means inflation could stay closer to 3% for much of the next couple of years and in an environment of strong growth and rapid job creation it adds to our sense that risks are increasingly skewed towards a late 2022 rate hike rather than 2024 as the Fed currently favors.

Our view on the future of Inflation

We currently view this as a mixed bag given the information above. The numbers suggested by ING and other analysts suggest the Fed will be forced to take action sooner. However the Vice Chair of the Fed confirmed to Bloomberg that they view any spike in Inflation as transitory in a theme consistent with Chair Jerome Powell. The Vice Chair also confirmed that once numbers are satisfactory they will by means of the minutes provide indication of any potential rate hikes.

Source: ING Research