- The UK Retail Sales rebounded 3.4% MoM in January, a big beat.

- Core Retail Sales for the UK rose 3.2% MoM in January.

- GBP/USD flirts with 1.2600 on upbeat UK data.

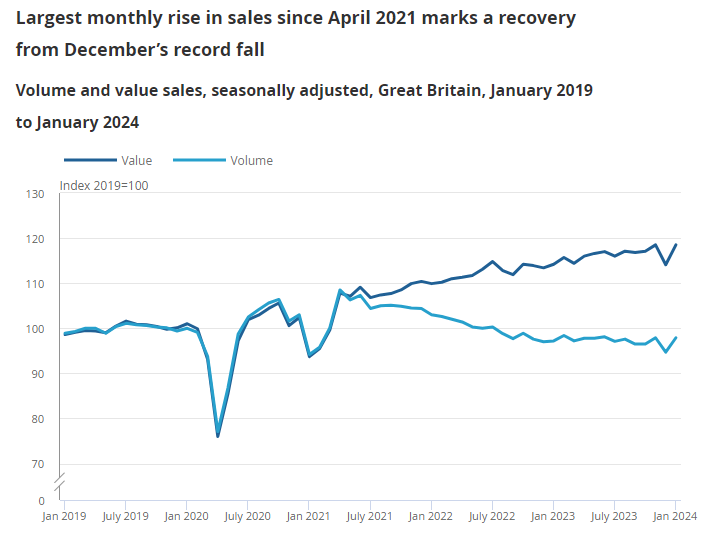

Retail sales volumes (quantity bought) are estimated to have rebounded by 3.4% in January 2024, following a record fall of 3.3% in December 2023 (revised from a fall of 3.2%). This was the largest monthly rise since April 2021. Scrutinizing the data and after the December drop off in retail sales, the UK is back where it was in November. This could perhaps explain the lack of bullish momentum from the GBP following the initial spike.

Source: ONS

Sales volumes in all subsectors except clothing stores increased over the month, with food stores such as supermarkets contributing most to the increase. More broadly, sales volumes fell by 0.2% in the three months to January when compared with the previous three months, however this was the smallest fall since August 2023.

Learn more about Financial Markets and learn to trade through an extensive accredited course right here https://lotusacademy.africa/product/skills-certificate-in-financial-markets/

Sales at food stores surged by 3.4% (vs -3.1% in December), led by receipts at supermarkets, and those at non-food stores advanced by 3.0% (vs -3.9% in December). Within non-food, trade at department stores and other non-food stores, such as sports equipment stores, rose over the month by 5.4% and 6.2%, respectively, with some retailers reporting the positive impact of January sales. Household goods stores rose by 1.8%, mainly due to sales in hardware stores, while clothing stores fell by 1.4%. Automotive fuel sales jumped by 5.4%, helped by falling fuel costs. On a yearly basis, retail sales rose by 0.7%, the largest increase since March 2022.

Market Reaction

GBPUSD initially bounced just over 20 pips to tap the 1.2600 handle but has since surrendered any immediate gins. The long term picture remains murky as US data continues to see the expecttions around rate cuts swing wildly. For now the range between 1.2500 and 1.2800 remains intact and without a breakout in either direction we could continue to see sideways and consolidative price action.

GBPUSD Daily Chart

Source: TradingView, Chart by Zain Vawda

Other Sources Used: FXSTREET. REUTERS, TRADINGECONOMICS