- Apple stock falls over 2% on Wednesday as markets sell-off.

- AAPL drops over $4 from all-time high.

- Apple shares are still in a bullish uptrend but looking shaky.

Apple stock suffered again on Wednesday as global markets continued their turnaround and the Fed dared talk of he who must not be named, tapering. Apple had been trending nicely higher at the start of the week, but this shows just how quickly things can turnaround. The stock put in a fresh all-time high on Monday, breaking through the psychological $150 level and hitting up to $151.68 before the latest sell-off set in. This was added to on Wednesday when the Federal Reserve released the minutes from its latest meeting.

It would appear from those minutes that the Fed is looking to begin tapering its massive stimulus program later this year which is sooner than many investors had penciled in. We have also mentioned before the massive correlation between the S&P 500 and the Fed’s balance sheet, so any tapering will likely lead to a tapering in equity purchases by investors. Rates are not set to climb anytime soon, witness the 10-year yield falling, but the party may be over for free money and equity market stimulus. Now we need to decide if this is a pullback or the start of a bearish trend.

Apple stock forecast

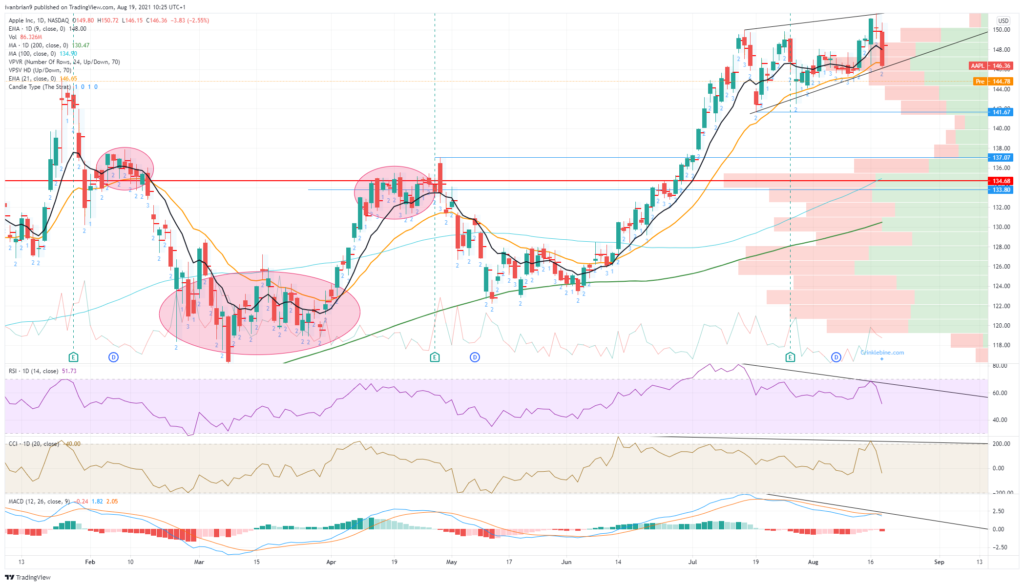

Apple remains in a bullish uptrend. Previously, we had identified a triangle formation that Apple stock broke out of when it breached $150. This had also broken a potential double top at $150. Now we can see from the chart below the bullish pennant formation that Apple has traded down to the bottom of. This is likely to be broken with a test of $141.67, which is now looking more and more likely. That is the key level to hold as volume thins out rapidly below, meaning a breakthrough should see the price accelerate. There is no volume profile support until $135. $134.68 is the point of control for all of 2021. The point of control is the price with the highest amount of volume. This is strong support then.

The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) remain in a downtrend and this was a pretty clear bearish divergence between the price making fresh all-time highs. While Apple remains just about in a bullish uptrend, it will likely break lower and target $141.67 or further down.

PRICE ACTION VIEW

On a bigger picture from a price action point of view while taking the recent chinese tech crackdown which has given no signs of slowing down, i will be keeping a close watch on this. Apple has a huge market share in China and continued crackdowns could adversely affect share prices.

We will be keeping an eye for potential long opportunities around the order block/demand zone around $124-$128 zone. As always price action will determine whether we get involved coupled with a fundamental outlook as well.

SOURCES: Zain Vawda and Ivan Brian