European Session & Asian Session

Shares in Asia gained Friday after a positive day on Wall Street, which included jobs statistics that backed the case for US interest rate reduction.

The MSCI Asia Pacific Index increased 0.7% as Hong Kong’s benchmark index touched its highest level since September, while shares in Japan, South Korea, and Australia also advanced. US futures rose somewhat as the S&P 500 index finished less than 1% off its all-time high on Thursday.

The Hang Seng rose after authorities said that they were contemplating a plan to exclude private investors from paying taxes on income earned from Hong Kong equities purchased through Stock Connect. Onshore Chinese equities dipped, however, as investors reviewed a story claiming that US President Joe Biden’s administration is set to announce a broad decision on China tariffs as early as next week.

For more trading tools, real time data and technical analysis visit us https://lotusacademy.africa/

The European session saw stocks rise in response to positive profit reports and US statistics that bolstered the case for interest rate reductions. On Friday, there will be a number of speakers from the Fed.

With a 0.9% rise, the Stoxx 600 was on track for its biggest weekly increase in almost three months. S&P 500 contracts increased by 0.4% following the index’s near-all-time high of less than 1%. The Dollar and Treasuries remained unchanged, but the pound weakened following reports that the UK economy was emerging from a brief recession.

The case for rate cuts was strengthened by higher-than-expected applications for US unemployment benefits on Thursday, which gave the market a further boost. The rise that had been driven by tech giants is being broadened by the so-called value and cyclical sectors, as traders await a significant US inflation print due next week.

Oil continued to rise into the third day as important technical levels offered a floor for declines.

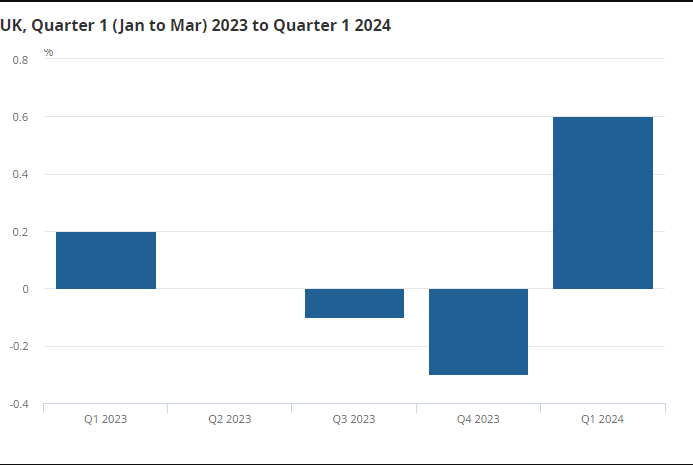

UK GDP Data

UK gross domestic product (GDP) is estimated to have increased by 0.6% in Quarter 1 (Jan to Mar) 2024, following declines of 0.3% in Quarter 4 (Oct to Dec) and 0.1% in Quarter 3 (July to Sept) 2023. Compared with the same quarter a year ago, GDP is estimated to have increased by 0.2% in Quarter 1 2024.

Source: FinancialJuice

View the Full UK GDP Report

According to Chancellor Hunt, today’s growth figures are proof that the UK economy is returning to full health for first time since pandemic.

Growth data saw a decent upside surprise this morning with all five GDP measures and the service numbers printing above the market’s maximum estimates. The Pound saw an initial pop higher on the data but is yet to see decent follow through on the move.

Learn more about Financial Markets and learn to trade through an extensive accredited course right here https://lotusacademy.africa/product/skills-certificate-in-financial-markets/

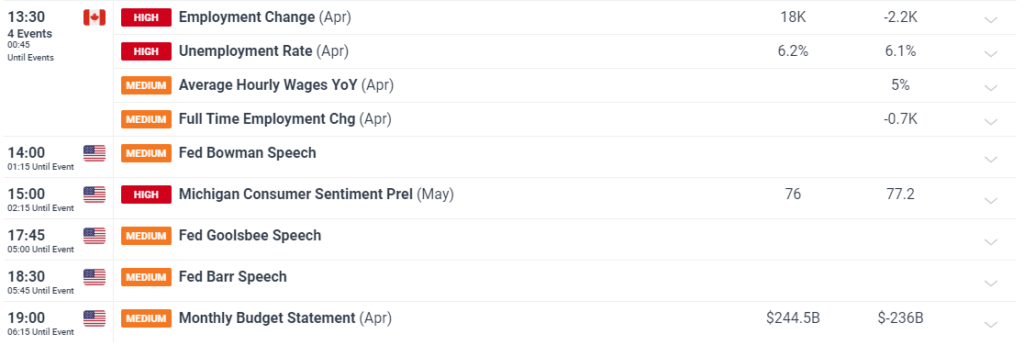

Looking Ahead to the US Session

The US session brings quite a bit of data today as well as a host of Fed speakers.

Yesterdays US session saw the case for rate cuts strengthen by higher-than-expected applications for US unemployment benefits, which gave the market a further boost.

The rise that had been driven by tech giants is being broadened by the so-called value and cyclical sectors, as traders await a significant US inflation print due next week.

Calendar set on GMT + 1 (UK Time)

Source: DailyFX

Article Sources: FinancialJuice, ING Economics and DailyFX