Market Sentiment

Bank of Japan Governor Kazuo Ueda said a monetary policy reaction may be needed based on the impact of foreign currency rates, which are a significant factor impacting the economy and inflation.

US shares fought for direction as investors sought new triggers to push the rise further. Treasury yields and the dollar increased. Former Treasury Secretary Steven Mnuchin said a strong currency is a benefit in helping the US fund massive budget deficits for the time being, but urged on the victor of November’s presidential election to lead a fresh drive to rein in the federal debt load.

S&P 500 contracts were unchanged on Wednesday after the underlying gauge had climbed in the previous four sessions. The benchmark Treasury yield increased two basis points to 4.48%. Oil dropped to its lowest level since mid-March, following a somewhat pessimistic US inventory data.

For more trading tools, real time data and technical analysis visit us https://lotusacademy.africa/

Investors winding down from earnings season and the S&P 500’s 3% surge in May are now wary of what happens next, as US authorities warn that betting on a shift to softer policy may be premature. Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, said the central bank is likely to maintain interest rates unchanged “for an extended period of time.” Rising rents in many rich nations are proving to be a persistent challenge for central banks as they attempt to bring down inflation once and for all during this tightening cycle.

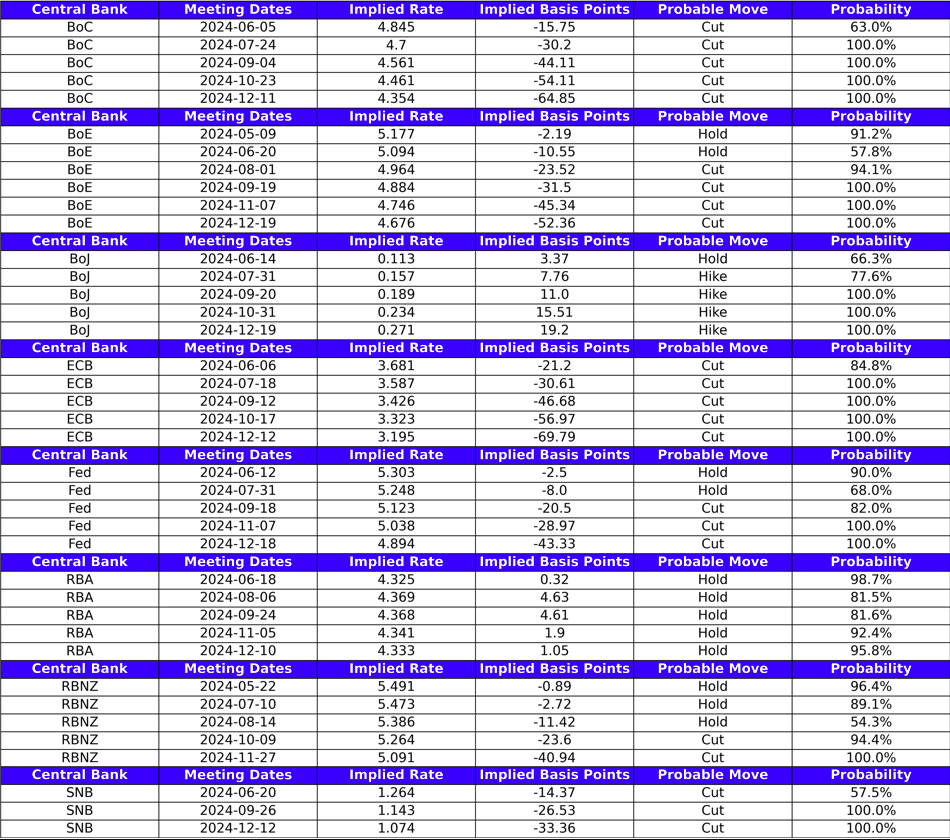

What is priced in for major central bank rate decisions?

Central Bank Interest Rate Probabilities

Source: FinancialJuice

The Fed’s more cautious approach has put it out of step with European central banks, which have already begun to ease. On Wednesday, Sweden’s Riksbank began its rate-cutting cycle, relaxing policy for the first time in eight years. This follows the Swiss National Bank’s move to lower interest rates earlier than its counterparts in March.

Learn more about Financial Markets and learn to trade through an extensive accredited course right here https://lotusacademy.africa/product/skills-certificate-in-financial-markets/

FX Update

Price action is a mixed bag across major asset classes due to the lack of any major fundamental catalysts.

FX reflects this with a mixed risk flows across the major currencies. USD still the strongest and continues to prove me wrong this week. Expected more weakness following the recent batch of data and the FOMC decision. The DXY is currently testing key resistance so will be keeping a close eye on it.

JPY still the weakest, with the AUD in second place. AUD weakest arguably driven by residual weakness from yesterday’s RBA decision, as well as the downside in both copper and iron ore.

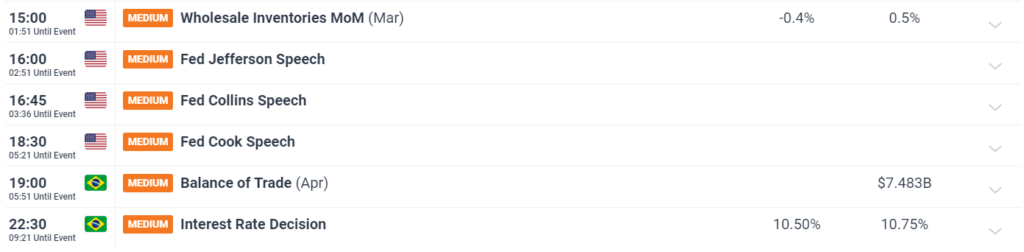

Looking Ahead to the US Session

No major economic data scheduled on the docket today but we do have more Federal Reserve policymakers who may speak more toward monetary policy. This could stoke short-term volatility but is unlikely to change the overall mood over the medium-term. Any gains or losses may prove temporary.

Calendar set on GMT + 1 (UK Time)

Source: TradingView

Sources Used: FinancialJuice, DailyFX