While the UK unemployment rate is likely to rise towards 6-6.5% this year as the furlough scheme comes to an end, there’s a fair chance the situation may already be gradually improving again by year-end, barring any more Covid-19 surprises. Also taking Brexit into account this seems realistic and achievable moving forward.

Job Market calms as winter approaches

The key question occupying most economists at this stage is where will UK unemployment be at years end- most would say ‘higher than it is now’. The challenge however remains in predicting just how high as this highlights how several aspects of the jobs crisis differs from previous recessions.

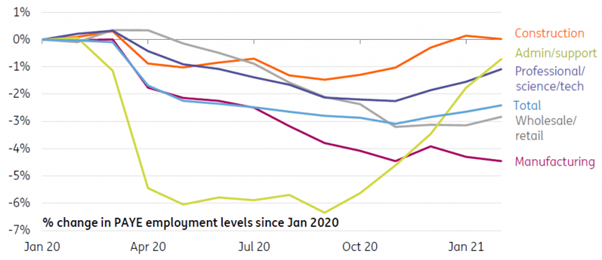

The notable difference from the past would be the furlough scheme which is expected to run through to end of September. However, payroll-based employment remains down some 2.4% on pre-pandemic levels, we have begun to see an improvement in numbers as firms become more adept at operating through lockdowns. Last week did see the return of many retail sectors including pubs with some restaurants in London said to be booked up until May. The admin/support sector, for instance, has now all-but-erased the 6.3% fall in employment seen amid the pandemic.

Unemployment is likely to rise through the middle of 2021

Still, there is likely to be a further round of redundancies as the job retention scheme gradually comes to an end. The spike in job losses we saw last autumn, as firms prepared for the original October 2020 furlough end-date, shows what is at stake. Jobs data due tomorrow is likely to show the unemployment rate at roughly 5%, up from its pre-pandemic low of 3.8%.

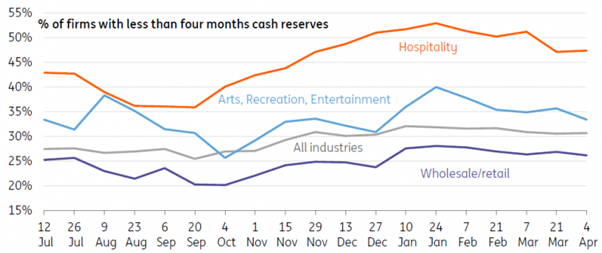

One concern is that consumer services firms remain under financial pressure. Office for National Statistics survey data consistently pointed to low cash reserves and weak confidence among the hardest hit sectors through the first quarter.

Hospitality firms are still on the ropes as well

Critical to take into account however is the continued struggle in hospitality sectors. Given the vaccination drive and the fact we are about to enter summer we do expect a huge boost to the sector as many UK citizens might opt for local travel and not travel into Europe as much. Hospitality industry is reporting of a significant decrease in cash reserves.

Migration is something of a wildcard for the jobs market

The second major difference compared to past recessions is the sharp spike in outward migration we saw last spring. This is attributable to Covid-19 as well Brexit as many Europeans opted out of the UK.

Economists are divided on its full extent, but recent ONS analysis suggests a 7.4% fall in the number of EU nationals on UK payrolls. That accounts for around a fifth of the drop in employment between 4Q19 and 4Q20.

This recovery may be quicker than past jobs recessions

Altogether, we think the UK unemployment rate will rise to 6-6.5% later this year. But unlike past recessions, it may not stay there for long. To explain why it’s worth reflecting on the fact that so many of the job losses have so far been concentrated in the consumer services industry – something that is undoubtedly another unusual feature of this crisis. These industries (encompassing hospitality and arts, recreation and entertainment, and other services) have accounted for around half of the total fall in employment in 2020.

One explanation is that the jobs market tends to be more fluid in these sectors. Here, jobs are often created much more quickly than elsewhere – perhaps linked to the fact that they tend to be more insecure forms of employment and are typically lower paid. Employee turnover is also noticeably higher in the likes of hospitality and arts/entertainment/recreation sectors than elsewhere – and the chart below shows a rough upward-sloping relationship between those sectors that have made the heaviest use of the furlough scheme and those with higher staff churn.

Conclusion and Our Outlook

As already mentioned the significant improvement in the vaccine drive from the UK coupled with retails stores opening and summer approaching we do remain optimistic. Also compared to the financial crisis in 2008 the furlough scheme will run till well after the economy is mostly open. In turn, this could mean the recovery in the overall jobs market towards pre-pandemic levels may be more rapid than after the global financial crisis.

Barring any significant change due to the pandemic or any further lockdown we could very well see a positive surprise is UK unemployment rate come year end.

Sources: ING