–EUR/USD has been making its way higher as Fed officials pressure the dollar.

–Europe’s improving covid statistics and upbeat business sentiment may keep its bid.

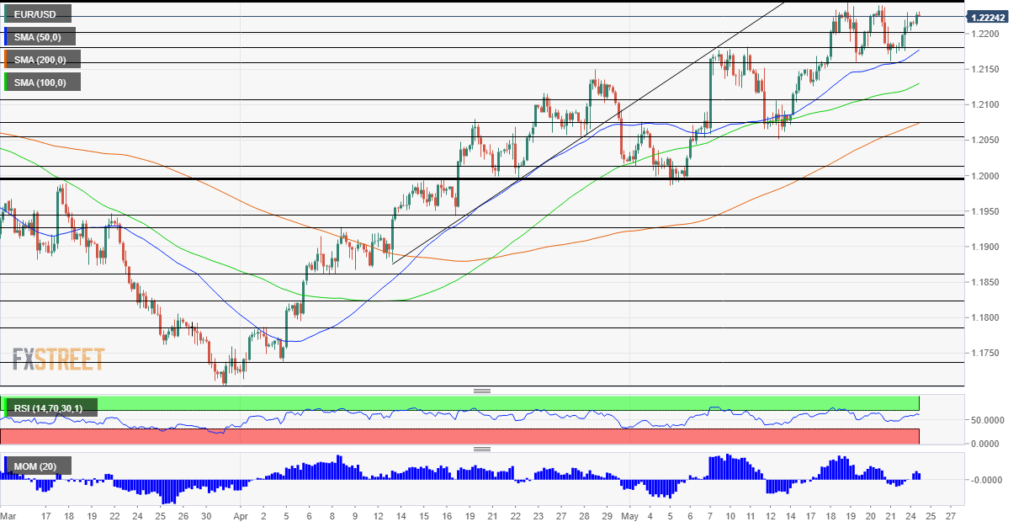

–Tuesday’s four-hour chart is bullish, but resistance is tough.

Is new energy from a long weekend enough for a breakout? Many European traders are returning to work only on Tuesday and they have reasons to push EUR/USD over the stubborn 1.2245 resistance line. It would be the fourth attempt.

The primary driver of the currency pair is the US Federal Reserve. Lael Brainard, Governor at the Federal Reserve, hailed the rapid economic recovery but reiterated the bank’s position that there is still a long way to go and that any inflation would be transitory. Her colleagues Raphael Bostic and Esther George – the latter being a known hawk – also supported that view.

As long as the Fed remains calm, the printing presses continue working – the bank buys $120 billion in bonds every month – and weakening the dollar. An interest rate hike is still beyond the horizon. Chicago Fed President Charles Evans and Randal Quarles are scheduled to speak later in the day.

The Conference Board’s Consumer Confidence measure for May will likely show an ongoing improvement in sentiment, yet investors will want to see if rising prices are curbing shoppers’ enthusiasm. Housing figures such as New Home Sales are also of interest.

What about the euro side of the equation? While German y marginally downgraded its Gross Domestic Product read from -1.7% to -1.8% in the second quarter, optimism about the future has likely remained elevated. The IFO Business Climate is set to advance from 96.8 points reported in April to higher levels.

Coronavirus statistics continue falling across the old continent, allowing countries to reopen to travel – except flying above Belarus. The return of British tourists to Spain and Portugal serves as a sign of normality. EU countries have vaccinated nearly 40% of their populations with at least one dose. While the US leads with almost 50% receiving one jab, the pace of inoculations is slowing.

All in all, EUR/USD has reasons to be cheerful.

TECHNICAL ANALYSIS

Euro/dollar is making its fourth attempt to challenge 1.2245, as seen on the four-hour chart. The currency pair is benefiting from upside momentum and has evaded a drop below the 50 Simple Moving Average. With the Relative Strength Index (RSI) well outside overbought conditions, there is more room to rise.

Above 1.2245, the next level of resistance is at 1.2280, followed by 1.2350, both seen earlier this year.

Support is at 1.22, which cushioned EUR/USD earlier in May. It is followed by 1.2175 and 1.2155, the latter holding up the pair last week.

SOURCE: FXSTREET, YOHAY ELAM