Auto parts sector update: A year of recovery and transformation

The automotive sector and major auto parts manufacturers are expected to recover some lost ground in 2021-2022, after a difficult year. In addition, key automotive players are undergoing a comprehensive transformation to align themselves better with the major sector trends, including electrification and digitalisation

Leading European auto parts manufacturers are recovering after a tough 2020

Major European car parts manufacturers survived a perfect storm created by the Covid-19 pandemic last year and are on the road to recovery in the current year. Aside from the continued Covid-19 overhang, parts manufacturers are affected by industry-wide megatrends, including an accelerated shift to the electrified and more autonomous and connected vehicles.

Auto parts producers take direct cues from car manufacturing and sales dynamics

Auto parts manufacturers depend heavily on car manufacturing production and sales volumes, as only a small portion of auto part volumes are sold into the aftermarket segment. Therefore, a recovery in new vehicle production and sales is the key driver for the performance of auto parts in 2021-22.

Automotive sector should benefit from the post-pandemic rebound

While the automotive sector was one of the worst affected by the Covid-19 pandemic, we note that the auto industry has been on a recovery path after a devastating second quarter of 2020 when some production was completely stopped and sales plummeted. Various industry sources expect new vehicle sales to grow by mid- to high-single digits and production by low- to mid-double digits year-on-year in 2021. Some new headwinds include a second wave of the Covid-19 lockdowns at the start of this year and ongoing semi-conductor shortages. For the moment, we assume that neither of these factors will derail the current base-case sector recovery scenario, though they may end up shaving some volumes off the original forecasts. However, until the Covid-19 pandemic has turned the corner in a decisive fashion, risks to the forecasts will remain.

Auto industry megatrends are another driver affecting leading parts manufacturers

We believe that the auto industry is in the midst of one of the most dramatic transformations in decades. Specifically, current industry themes include electrification, the shift towards more intelligent and autonomous driving, greater digitalisation, connectivity and infotainment requirements, among other sub-trends. These themes pose challenges for and shape the strategies of the leading car and auto parts manufacturers at the present moment. In fact, we believe that we are approaching a much greater fusion between tech companies and the auto sector.

Demand for passenger cars expected to rebound in 2021

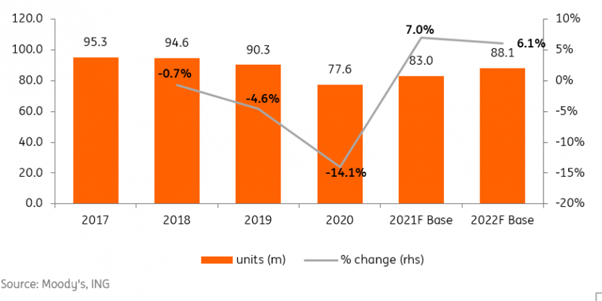

After a dramatic reduction in passenger car sales and production volumes last year, based on our base-case global economic recovery scenario across key regions, we believe that global light vehicle sales will rebound in 2021, potentially by 7% to 9%, depending on various industry forecasts. Specifically, Moody’s expects that under its base-case economic scenario (including 5.3% real GDP growth in the G20 economies), global light vehicle unit sales will grow by 7.0% YoY in 2021 to 83.0m. Valeo, in its recent outlook for 2021, indicated that its base case scenario for the industry assumes 10% growth in global automotive production this year. Faurecia expects a recovery in worldwide automotive production by more than 15% (to 82.3m units) over the two-year period of 2020-22. Schaeffler, more conservatively, is basing its current guidance on global light vehicle production growth of 7.2% in 2021.

While sales are expected to rebound from the lows in 2021 and continue to grow in 2022, Moody’s doesn’t expect sales to return to the pre-Covid peak of approximately 95m units seen in 2017-18 until much later, potentially around 2025. Faurecia forecasts returns to the above-90m production volume level by 2025. Overall, Faurecia projects an automotive production cumulative annual growth rate (CAGR) of 5.2% over 2020-25.

Also, we caution that while the prospect of mass vaccination gives hope and underpins our and the market’s expectations, any renewed spikes in the virus could create some downside to the aforementioned forecasts.

Global light vehicle sales expected to recover in 2021

Chip shortages pose some headwinds

Another development which might dampen production volumes somewhat in 2021 involves an ongoing shortage of the semiconductors required for the production of new cars. While we currently assume that the OEMs may catch up and compensate for much of the first half loss of production during the remainder of this year, the situation is still developing and may result in smaller production volumes for the full year than is currently expected. Moody’s currently anticipates that the negative impact of the semiconductor supply shortages this year could reduce production volumes by around 2% in 2021.

Pace of recovery expected to differ across key regions

We note that the rate of the Covid-19 impact on auto sales has been uneven across regions and thus the anticipated rate of recovery should be as well. Western Europe and North America suffered more in 2020 (with light vehicle sales down 23.7% and 16.5%, respectively), while China’s auto sales have held up better (down by much more modest 1.9%). Conversely, the rate of recovery in 2021 should be more pronounced in Europe and North America (+11.2% for Western Europe and +5.6% for the US) relative to +4.0% for China, according to Moody’s base-case forecast. S&P expects US light-vehicle sales to increase by 10-15% in 2021, to over 16m (before stabilising at around 16.5m in 2022). Faurecia, during its recent Capital Markets Day, commented that it expected Chinese vehicle production volumes to equal or exceed the pre-Covid-19 volumes this year with North America returning to or exceeding pre-Covid-19 levels by 2022. During its FY20 announcement, Stellantis summarised its regional 2021 outlook as follows (utilising various industry sources and its own estimates): North America +8%, Europe +10%, China +5%, Middle East & Africa +3%, South America +20% and India & Asia Pacific +3%.

Auto parts sales growth to exceed the recovery in auto sales

As we have already mentioned, auto parts manufacturers are affected by the same dynamics as global and regional auto sales and have felt the impact from the Covid-19-related drop in production and demand. Moody’s predicted a 16-17% drop in aggregate organic revenues of European auto parts suppliers last year, followed by a rebound of 11-12% and 9-10% in 2021 and 2022, respectively. The rating agency expects that the organic revenue growth of the European auto parts suppliers will exceed the global auto sales growth rate by some 200 to 300 basis points. We note that leading European auto parts manufacturers also aim for outperformance vis-à-vis the underlying production volumes during this year.

Electrification a key sector theme for the years to come

While electrification has been an ongoing theme for the auto sector for some time already, we are witnessing a notable acceleration in the pace of sales of electrified vehicles and in the auto manufacturer’s own production targets. Recently, Jaguar Land Rover announced plans to “reimagine” Jaguar as an all-electric brand by 2025 and Ford to move its passenger-vehicle range in Europe to an all-electric basis by 2030 (from effectively zero last year). Schaeffler during its recent presentation said it expected the pace of electrification to increase sharply, with the battery and fuel cell-powered vehicles expected to reach 50% of the fleet by 2035, with the share of the hybrid electric vehicles (HEV) and internal combustion engines (ICE) to decline to 35% and 15%, respectively.

This trend is driven in part by various regulatory environmental targets. The European Union is focused firmly on reducing automotive emissions, with the regulations requiring car manufacturers to cut fleet-wide emissions on new models to an average of 95 grams of carbon dioxide (CO2) per kilometre from this year.

At the national level, individual European countries have their own targets of increasing the electric vehicle (EV) share in new car sales, reaching 100% within 5 to 15 years. Outside of Europe, China, the largest passenger vehicle market, aims for a 25% share for EVs in new passenger car sales by 2025.

Other supportive factors for the further proliferation of EVs include increasingly competitive price points and various government incentives for purchasing such new vehicles. According to the ACEA, HEVs represented 11.9% of total passenger car sales in the EU in FY20 (up from 5.7% in FY19) and electrically chargeable vehicles (ECV) represented 10.5% of new car registrations in the region (up from 3.0% the year before). BNEF predicts that global EV sales may jump to as high as 50% of new car sales in 2021. However, we also note that infrastructure bottlenecks, such as the availability of charging points, may need to be addressed in order to keep pace with the proliferation of EVs.

Auto sector converging with the tech world

Stemming from the aforementioned industry megatrends, we note an increased convergence between the auto sector space and traditional non-engineering technology companies. Auto sector media coverage in the last few weeks and months included headlines about numerous partnerships between OEMs and tech companies. As we have already commented in our previous sector publications, Big Tech and other technology companies are increasingly eyeing the automotive space. Be it Apple reportedly aiming to launch electric car production for the mass market by 2024, Google developing self-driving cars, or Microsoft teaming up with General Motors and other car manufacturers. Various technology-driven companies and start-ups also operate in the auto space, aiming to capture an early mover or new technology advantage. In essence, passenger cars are evolving further into something broader than a means of transportation but also a means of communicating, connecting and providing entertainment on the go, drawing interest and expertise from outside the traditional sectoral perimeter. While cooperation is beneficial in terms of sharing know-how and costs, there is a risk that potential new entrants or technologies will put more pressure on existing auto sector players.

Original Article: ING Think and Economic Analysis