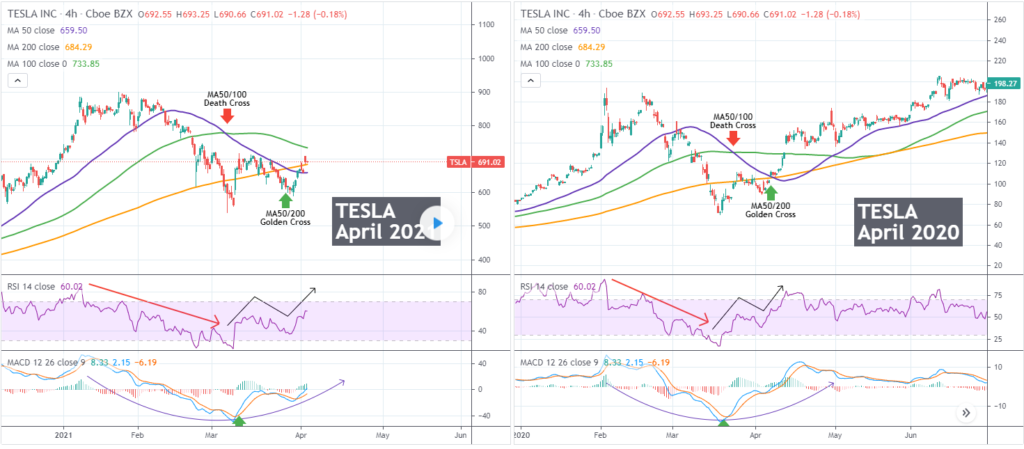

Technical Perspective

As you see the two charts are fairly self-explanatory. Both in 2020 and now (2021), TSLA had already made a top by early February, formed a MA50/100 Death Cross, followed by a MA50/200 Golden Cross (on the 4H chart) that practically put the bottom behind. The RSI and MACD sequences are also fairly identical.

Fundamental Perspective

On a more fundamental aspect Tesla’s, and CEO Elon Musk’s, position on their bitcoin investment seems to be to hold. With this in mind the carmaker has in some way linked its share price to the cryptocurrency and in turn could make a huge return should the majority of analyst calls on Bitcoin prove to be true. As more companies and funds invest money into Bitcoin we are seeing a bit of stability relative to Bitcoin’s history. Should the crypto keep rising I believe we could see a continued rise in the share price of Tesla.

Given the increasing interest and adoption of electric vehicles in many countries we could definitely see improved performance by Tesla even if that is confined to the US Market. Tesla faces stiff competition in Europe after recent announcements by VW and BMW while Emerging Markets presents its own set of challenges.

Given all of the above we are bullish on Tesla. I will leave the question to you….

Is it time to buy the carmaker again?