EUR/USD, “Euro vs US Dollar”

After completing the descending wave at 1.2071 along with the correction towards 1.2151, EURUSD is falling to break the low of the first descending wave. Possibly, the pair may continue trading within the downtrend with the short-term target at 1.2012. Later, the market may start another correction to reach 1.2080 and test it from below.

GBP/USD, “Great Britain Pound vs US Dollar”

GBPUSD is still falling towards 1.4027. Later, the market may correct to reach 1.4087 and then resume falling with the first target at 1.4010.

USD/JPY, “US Dollar vs Japanese Yen”

After breaking 109.39 to the upside, USDJPY is consolidating above this level. Possibly, the pair may resume trading upwards with the short-term target at 110.40.

USD/CHF, “US Dollar vs Swiss Franc”

After completing the ascending impulse at 0.9078 along with the correction towards 0.9029, USDCHF is forming a new consolidation range around 0.9088. After that, the instrument may resume growing with the short-term target at 0.9146.

AUD/USD, “Australian Dollar vs US Dollar”

After finishing the descending wave at 0.7730, AUDUSD is expected to continue trading within the downtrend with the short-term target at 0.7649.

Brent

After completing another ascending wave at 69.74, Brent is correcting towards 68.05. After that, the instrument may form one more ascending structure with the target at 70.90.

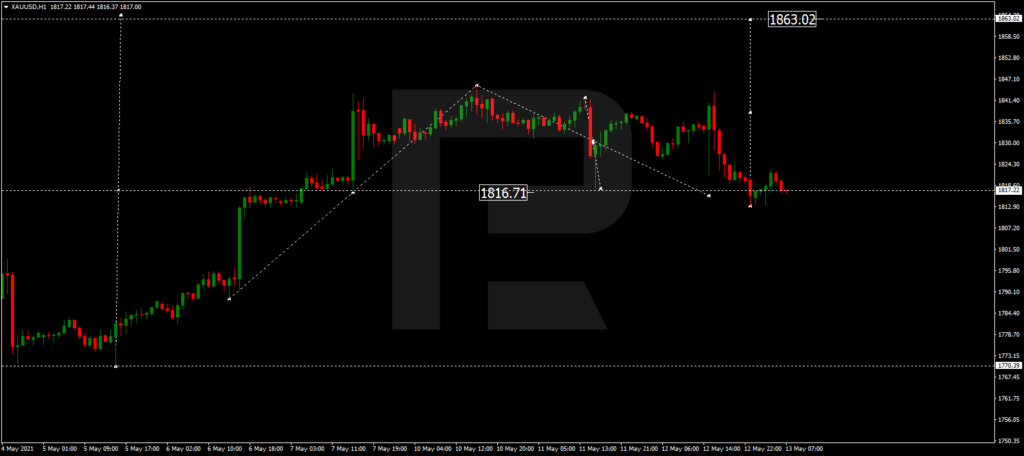

Gold

After finishing the correction at 1817.22, Gold is consolidating above this level. If later the price breaks this range to the upside, the market may resume trading upwards with the target at 1863.00; if to the downside – continue the correction to reach 1780.00.

S&P 500

After completing the descending wave at 4144.8 and then forming a new consolidation there, the S&P index has broken it to the downside. Possibly, today the asset may fall to each 4047.0 and then start another correction to test 4144.8 from below.

With the end of the week approaching please trade safe. Use all analysis in accordance with your own strategy. Enjoy

SOURCES: FXSTREET