Gold seems to have encountered strong resistance near $1,760, where the 50-day SMA is located, following Thursday’s decisive upsurge. On a bullish note, however, Friday’s downward correction lost momentum near the 20-day SMA at $1,731 and XAU/USD finished the week near the Fibonacci 23.6% retracement of the January-March downtrend at $1,745.

Meanwhile, the Relative Strength Index (RSI) indicator stays afloat above 50, suggesting that sellers are struggling to dominate gold’s action.

As mentioned above, the initial hurdle could be seen at $1,760 and a daily close above that level could open the door for additional gains toward $1,785 (Fibonacci 38.2% retracement). On the other hand, if XAU/USD stays below $1,745 and confirms that level as a resistance, it could retest the 20-day SMA at $1,731 and target $1,720 (static level) afterward.

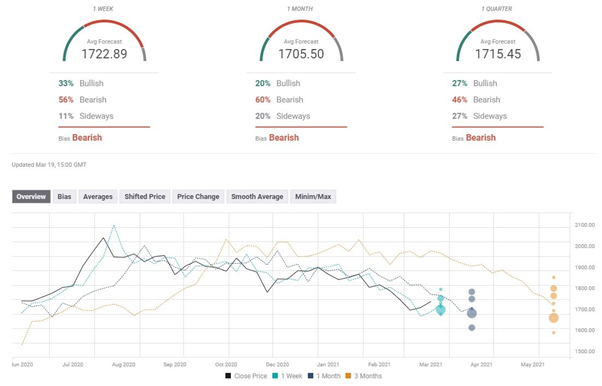

Gold sentiment poll

Gold’s near-term outlook remains neutral with a slight bullish bias according to the FXStreet Forecast poll. However, the average price target of $1,745 on a one-month view suggests that gains are expected to remain limited around current price levels.

Source: FXStreet.com